BUYING A HELICOPTER

What you need to know about insuring your aircraft

Knowing in advance what your annual insurance costs will be helps you make an informed purchase decision.

By: HeliTraderPosted on: March 2, 2023

Insurance is a key consideration when purchasing an aircraft. The aircraft make and model, its price, its intended use, and the experience of the pilot(s) will all play into the insurance cost — and these days, that cost can be a shock. Knowing in advance what your annual insurance costs will be helps you make an informed purchase decision.

The insurance industry on a whole is paying out more than ever. More destructive forest fires, bigger and more common storms, wars and unrest, and a recent trend in litigation to award massive sums of money in aviation lawsuits, are directly affecting the price and ability to get aviation insurance.

To protect their businesses, insurance companies are not only raising rates and deductibles, but also adding conditions to insurance policies. For these reasons, it’s important for helicopter buyers to talk to insurance brokers well before purchasing an aircraft to understand what insurance will add to the overall operating costs of the aircraft of their choosing.

When it comes to insurance, there are basically two types of insurance for your aircraft: liability and hull coverage.

Liability coverage

Liability coverage is typically sold as combined single limit (CSL), which includes the coverage of damage to third party entities and property, as well as passenger liability coverage of your passengers’ injuries and final expenses in the event of a fatal accident. Typically, light helicopter policies begin at $1 million in liability coverage. However, depending on the aircraft, the pilot(s), and how the aircraft is operated, it is possible to obtain $10, $25, $50, or even $100 million.

This insurance can cover the total cost of an accident or incident up to the coverage amount, or, as is more common, can be sublimited per passenger. Sublimited coverage will note the limit of coverage for each passenger. For instance, a $1 million policy could have a $100,000 per passenger limit. Each passenger is entitled to up to $100,000 if they are hurt or die. The remainder of the $1 million would cover damage to property or others outside the helicopter.

Hull coverage

Hull coverage can cover the full value of the aircraft, whether it is on the ground, in motion on the ground, or in flight. Depending on the financing of your aircraft, you can often opt into one, two, or all three of these options.

Hull coverage is the more expensive of the two insurance options. This insurance is designed to fully repair or replace your aircraft and its onboard equipment. The value of the aircraft and all of its onboard equipment is factored into determining the full policy coverage.

It is typical for annual hull coverage premiums in the U.S. to range between five and 10 percent of the value of the aircraft, says Rod Ritter, president of Velocity Insurance Group. Similarly, your hull deductible can be between five and 10 percent of the aircraft’s value, depending on the situation.

This means, if you had a $1.5 million policy on a helicopter, your annual hull coverage could be between $90,000 and $125,000.

These prices are considerably lower in Canada due to a lower instance of litigation and full insurance coverage awards, said Ritter.

What determines how much coverage I can get and the cost?

Several factors figure into the cost of liability and hull coverage. For first-time helicopter owners, the largest factor tends to be pilot experience.

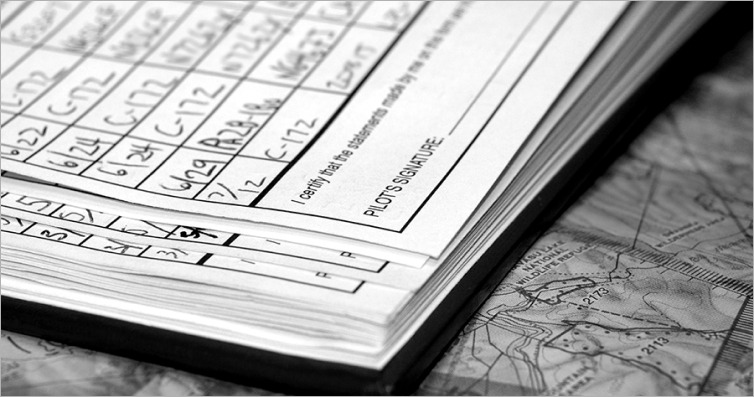

“Cost and liability limits are almost always dictated by the experience of the pilot,” noted Ritter. “If you were a brand-new pilot hoping to learn to fly in your new aircraft, or you are a low-time piston helicopter pilot transitioning to your new turbine helicopter, you’re going to be looking at much higher premiums than a pilot with thousands of hours and several hundred in type.”

Other factors that are considered in premium costs include how the aircraft is stored, how much it flies a year, and the aircraft’s typical use.

Ritter offered an example of a 500-hour piston pilot purchasing a used, light single-engine turbine aircraft. This pilot could secure a $1 million liability and full hull coverage for between six and 10 percent of the hull value. That insurance would also stipulate a minimum number of annual hours of recurrency training from a third party approved by the insurance company, whether that be a pilot, a flight training company, or the helicopter factory school.

What kind of insurance should I get?

Ideally, a new owner will want to purchase liability and hull insurance to protect themselves from crippling litigation in an accident and recover the cost of the aircraft.

Be aware, however, if you are financing your aircraft; your financing institution will have its own insurance requirements, including minimum coverage amounts. They’ll want to ensure they’re protected from any potential litigation and, in the event of a complete or partial loss of the aircraft, that their loan balance is covered and can be paid off with the insurance proceeds.

“When there is an accident, your insurance is the first source of cash to pay for damages, injuries, and death,” said Jarrod Burton, senior vice president of Echo Aviation Leasing. “If that is not enough insurance, lawyers could look to go after the bank, finance company, or leasing company, which could also be named in a lawsuit. For this reason, your finance institution may dictate the type of insurance you have and that they be listed as an additional insured and first loss payee on the policy.

“Same thing if you lease the aircraft. You’ll need to list that company. Some insurance companies don’t charge to have additionally insured. Some do. It’s important to know all the parties and how they’ll be involved in the insurance to get an accurate insurance quote.”

What if I can’t get insurance?

While insurance companies are turning down more and more pilot owners for insurance based on their experience, there are ways to lower the risk and obtain insurance. Ritter says hiring a pilot qualified in type who will always be second-in-command whenever the pilot owner flies can help secure insurance and lower premiums.

Another option, according to Burton, is to consider having the aircraft managed by a company with an operational history and ask for it, and the pilot owner, to be added to the company’s insurance. An established helicopter operator with a training program and currency requirements for its pilots could add the aircraft and the owner pilot to its insurance with a lease agreement, then ensure the owner pilot receives the training and currency required to fly the aircraft under the terms of the insurance, he added.

Do I have to have insurance?

In Canada, every aircraft registered or operated in the country is required to have liability insurance that covers public liability and risks of injury to passengers.

In the U.S., however, there is no law requiring insurance. The provider of your financing will have requirements, however.

Some owners with the financial means will choose to decline hull insurance, opting instead to self-insure.

Choosing to opt out of liability insurance is another story.

“A lot of people are surprised at the cost of insurance, and I have had clients say they aren’t concerned about liability or that they don’t want the liability because the insurance company is requiring annual recurrency training,” said Ritter. “I understand recurrent training can be expensive, but it serves a higher purpose than allowing you to have insurance. It’s very valuable training and helps increase your own safety and reduce risks of a terrible accident. When a client pushes back on that, it is a big red flag and will turn away insurance underwriters.

“My advice is to invest in a good third-party training company and utilize them to maintain your proficiency and build your skills. How well trained you are is one of the largest factors in determining whether underwriters will provide coverage with large limits at a good rate.”

Airbus AS350B3+

USD $ 1,785,000

Year: 2009

Bell 505

Contact seller for price

Year: 2018

Airbus H125

Contact seller for price

Year: 2013

Bell 407HP

Make an offer

Year: 1999

Robinson R44 Raven II

USD $ 275,000

Year: 2004

Bell 505

USD $ 1,950,000

Year: 2021

Airbus AS350B2

Contact seller for price

Year: 2000

Leonardo AW109SP

Contact seller for price

Year: 2018

Bell 206B3

CAD $ 750,000

Year: 1977

Airbus AS355F1

Contact seller for price

Year: 1982